Payday hits

You feel that brief wave of relief

And then somehow—without doing anything that feels wild—most of it’s gone within a few days

Sound familiar?

You’re not alone.

It’s not about poor decisions. It’s that the money often has somewhere to go before you’ve even had a chance to think

So the question isn’t just how to spend it—it’s when to decide

And for most people, that moment needs to come a lot sooner than it does

Most of the damage happens in the first 72 hours

That’s when the balance looks full

You feel a little breathing room

And it’s easy to think you’ve got more margin than you actually do

You ever bought something in that first rush of payday confidence—then realized later it threw the whole month off?

It doesn’t take much

One extra meal out

A few “I deserve this” purchases

A payment you forgot was coming

And suddenly, it’s another month of juggling and stressing

What helps is deciding in advance where things go

Not a strict budget

Not a spreadsheet

Just a handful of quick, intentional moves that happen right after you get paid

Before the money starts drifting into places it doesn’t belong

Here’s what that looks like for a lot of people

Handle the fixed stuff first—automatically

The rent

The bills

Any non-negotiables

If those get paid right away (or are set to leave automatically), you don’t have to wonder what’s left

You already know

And more importantly—you can’t accidentally spend what was never yours to play with

Move what’s for saving—out of sight

Even if it’s just a small amount

Even if you think, “I’ll move it at the end of the month if there’s anything left”

Most people won’t

Not because they’re lazy

But because life will eat it first

When you move it up front, it’s protected

And when it’s not in your spending account, you’re less likely to treat it like it’s available

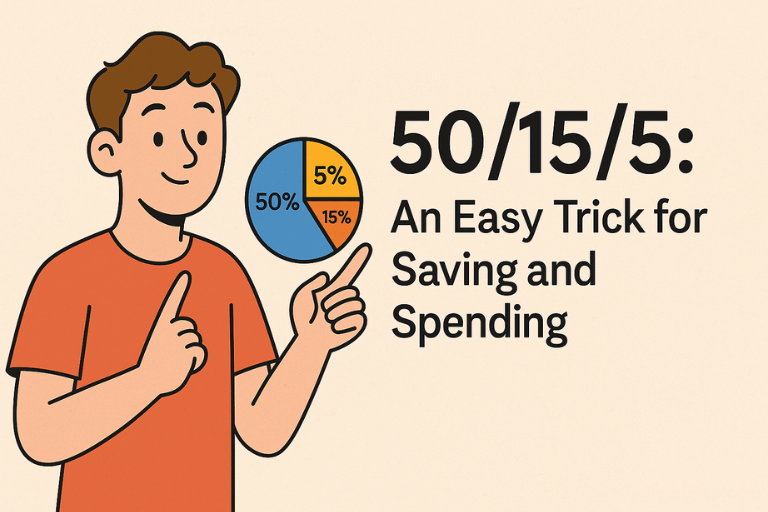

Create a spending container

Some people call it a second account

Others just keep a number in mind

But the idea is simple: give yourself a clear amount for flexible spending

Groceries

Gas

Small stuff

And let that be the boundary

Not because you’re trying to restrict yourself

But because uncertainty is where most overspending happens

Check your calendar—not just your balance

This part gets skipped a lot

You see what’s in your account, but forget what’s coming next week

Birthdays

Events

A weird utility bill that always hits mid-month

If you look ahead at your calendar before you start spending, you’ll probably spot a few things early enough to adjust

And it’s way easier to adjust now than it is to recover later

Final Thought

Getting paid feels good

Losing track of your paycheck before you even get a chance to use it?

Not so much

The people who feel most in control of their money aren’t necessarily earning more

They’re just deciding faster

Before the decisions get made for them

You don’t need a perfect plan

You just need a few small moves that happen early—before the drift sets in

That’s what makes the rest of the month feel lighter

Note: This content is for entertainment purposes only and is not financial advice. Please consult a qualified financial advisor for guidance specific to your situation