You get paid

You cover what you can

And by the time the 20th rolls around, it’s back to “just get me to the end of the month”

Sound familiar?

You’re not alone

It happens to a lot of people—and it doesn’t always mean you’re doing something wrong

But it does usually mean something’s working against you, quietly, every single month

The money comes in—and it disappears just as fast

For many people, their paycheck has already been spent before it even arrives

You’ve got rent or the mortgage

A couple of bills that hit right after

Then groceries, gas, maybe a payment or two

And boom—you’ve only just had a moment to breathe before the balance starts shrinking

By the 20th, you’re staring at the calendar

Doing mental gymnastics to figure out what still needs to be paid

And wondering how you’re going to stretch $47 over the next 10 days

The problem isn’t income—it’s timing

Here’s something to think about:

It’s not always about how much money you make

It’s about when you need it and where it’s going before you’ve had a chance to think

Some people spend like everything’s handled because it feels like it is for the first few days after payday

But those early decisions create the crash that shows up right on schedule every month

Ever looked at your bank account mid-month and thought, “Wait—how did I get here again?”

Most people are living in two parts of the same month

The first half feels okay

You’re buying what you need

You might even treat yourself to something small just to feel normal

Then the second half arrives

And suddenly, everything tightens

You go from “we’ll figure it out” to “we don’t talk about money right now”

That shift isn’t just about spending

It’s about pressure

So how do people avoid it?

They usually do one of three things—sometimes all three

And none of them are earth-shattering

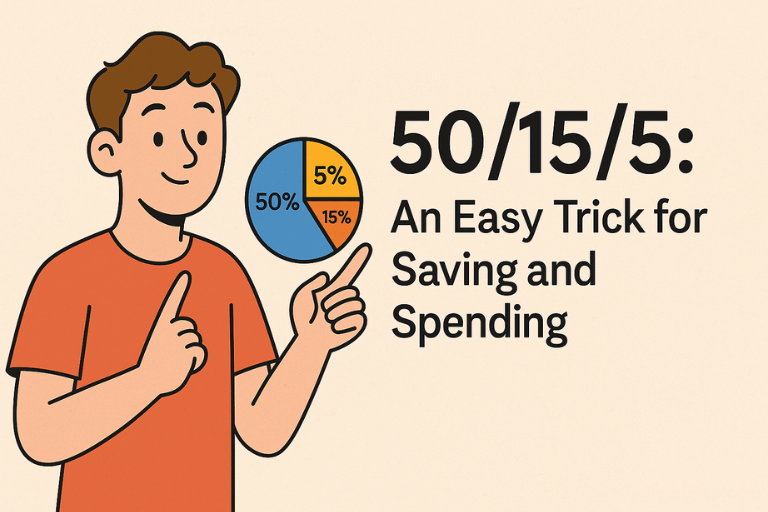

1. They break the month into smaller pieces

Instead of spending from a full paycheck, they mentally split it in two

Half for the first two weeks

Half for the second

That way, there’s something left

Not because they earned more

But because they decided how to stretch it before the stretch arrived

Sounds simple, right?

But it’s the kind of simple that takes practice

2. They automate what disappears first

Rent, bills, payments—they set those to go out automatically

So there’s no pretending the money is available

No illusion of more than what’s really there

When the big stuff is handled early, what’s left is real

And easier to manage without guessing

3. They make a plan for “invisible money”

You know the $9 lunch here, $6 coffee there, $40 “quick grocery run”?

Those aren’t bad decisions

But if they don’t have a name or a limit, they’ll quietly derail everything

The people who stop hitting zero mid-month aren’t depriving themselves

They’re just giving those tiny costs a place to live before they show up

Final thought

If you always feel broke by the 20th, it probably means the first 10 days after payday are doing more damage than you think

Not because you’re reckless

But because you’re reacting in real-time without much room to breathe

And once the month gets away from you, it’s hard to get it back

Some people don’t earn more

They just structure things differently

Not perfectly

Just enough to stop hitting that mid-month wall

That’s the difference between surviving the month

And actually getting to the end of it with something still in your account

Note: This content is for entertainment purposes only and is not financial advice. Please consult a qualified financial advisor for guidance specific to your situation.